Comparing Arizona Nationally On Debt

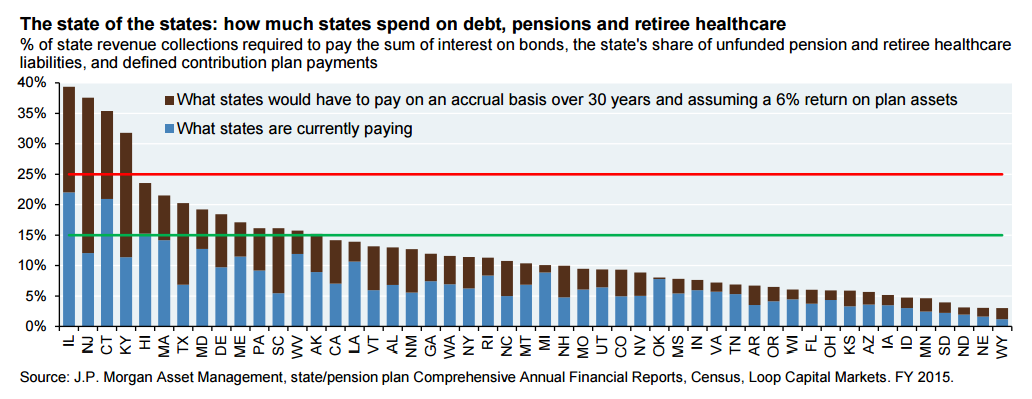

Arizona has one of the lowest expenditures on debt, pensions and retiree healthcare in the country in a ranking published by Governing Magazine. The analysis is provided by J.P. Morgan Asset Management.

Charles Chieppo, a research fellow at the Harvard Kennedy School’s Ash Center and a Governing Contributors, writes:

“The good news is that in 36 states it would take less than 15 percent of revenues to amortize liabilities over 30 years; in another 10 it would take between 15 and 25 percent of state revenues.

Three of the four states in the worst trouble -- Connecticut, Kentucky and Illinois -- already have effective tax rates that are among the nation's highest. Rarely is there much of a political appetite for tax increases, but it seems particularly unlikely that voters in these states would support higher taxes as a significant piece of any fix.”

FACTS ABOUT ARIZONA:

- The state of Arizona paid off nearly $510 million in debt in FY 2015 and FY 2016.

- Additionally, in the FY 2017 budget, the state of Arizona will pay $232 million in deferred payments (rollovers), including $200 million to universities, $11 million to the Department of Child Safety and $20 million to the Department of Economic Security.

- According to J.P. Morgan Asset Management, it would take less than 10 percent of state revenues over the next 30 years to pay liabilities owed.

- States with similar populations to Arizona (IN, TN, MO, MD, MA) would need to pay a higher percentage of their revenues to pay their debts in 30 years.

- Maryland would need to pay more than twice as much as Arizona. Of those states, Arizona has lower debt than MO, MA, and MD, according to State Budget Solutions.

HOW PROPOSITION 124’S PASSING WILL HELP STABILIZE ARIZONA’S PUBLIC SAFETY PERSONNEL PENSION PLAN:

- Proposition 124’s passing will restore financial stability to the Public Safety Personnel Retirement System, which provides pension benefits for police and firefighters.

- Currently the pension system’s obligations exceed its assets by more than $6 billion.

- Prop 124’s passing is projected to save taxpayers $1.5 billion over the next 30 years.