FY22 Budget

Tax Relief #ForArizonans

Arizona’s Economy Is Booming

Arizona’s economy is booming. Over the last several years we’ve solidified a reputation as a beacon of economic prosperity. It’s easy to see why: people are tired of burdensome overregulation and high taxes, and companies are relocating to states like Arizona that embrace free enterprise and bringing high-paying jobs with them.

Personal income rose last year at a rate faster than nearly any state in the country and an expected 325,000 jobs will be added by Spring 2022.

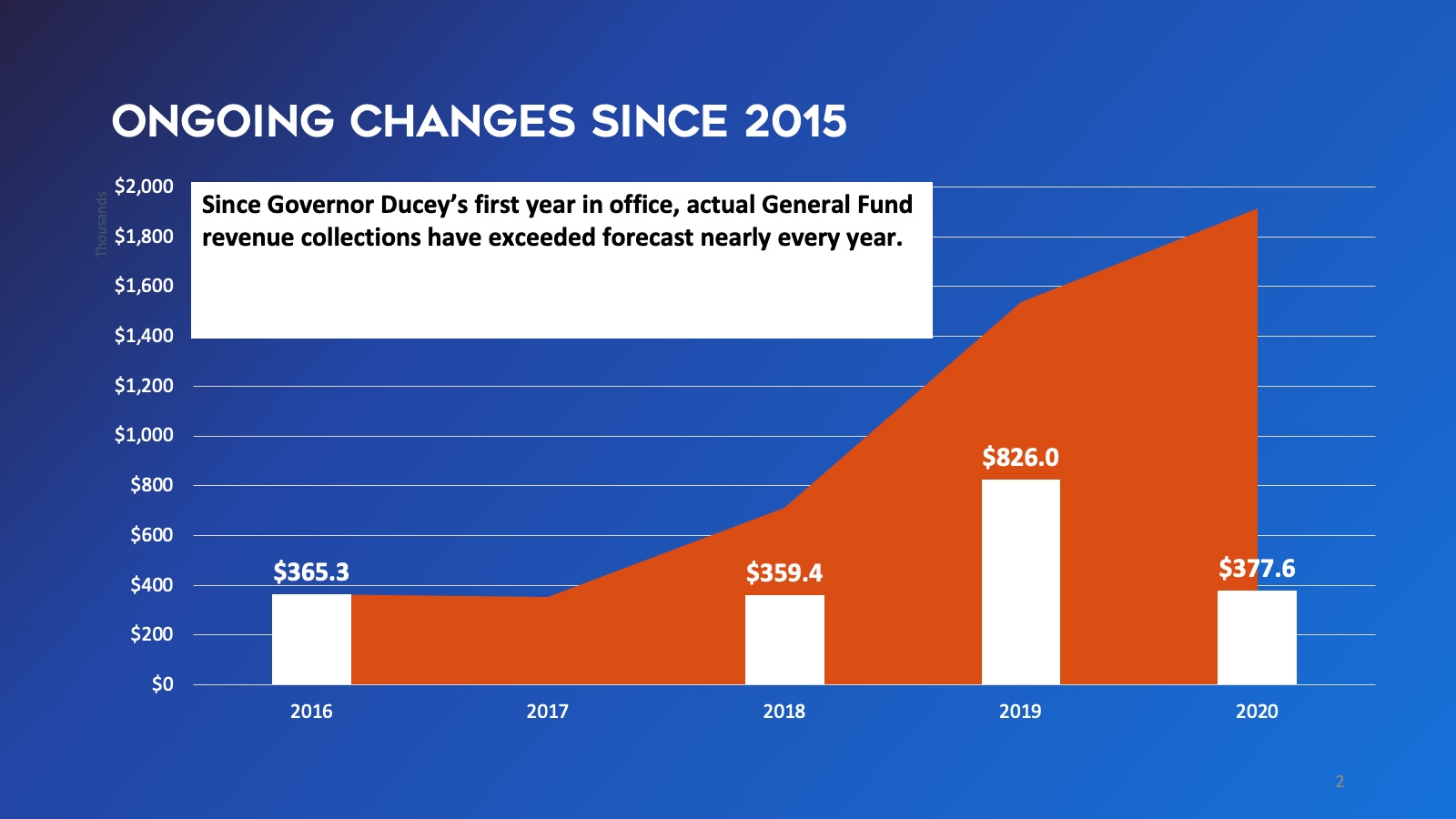

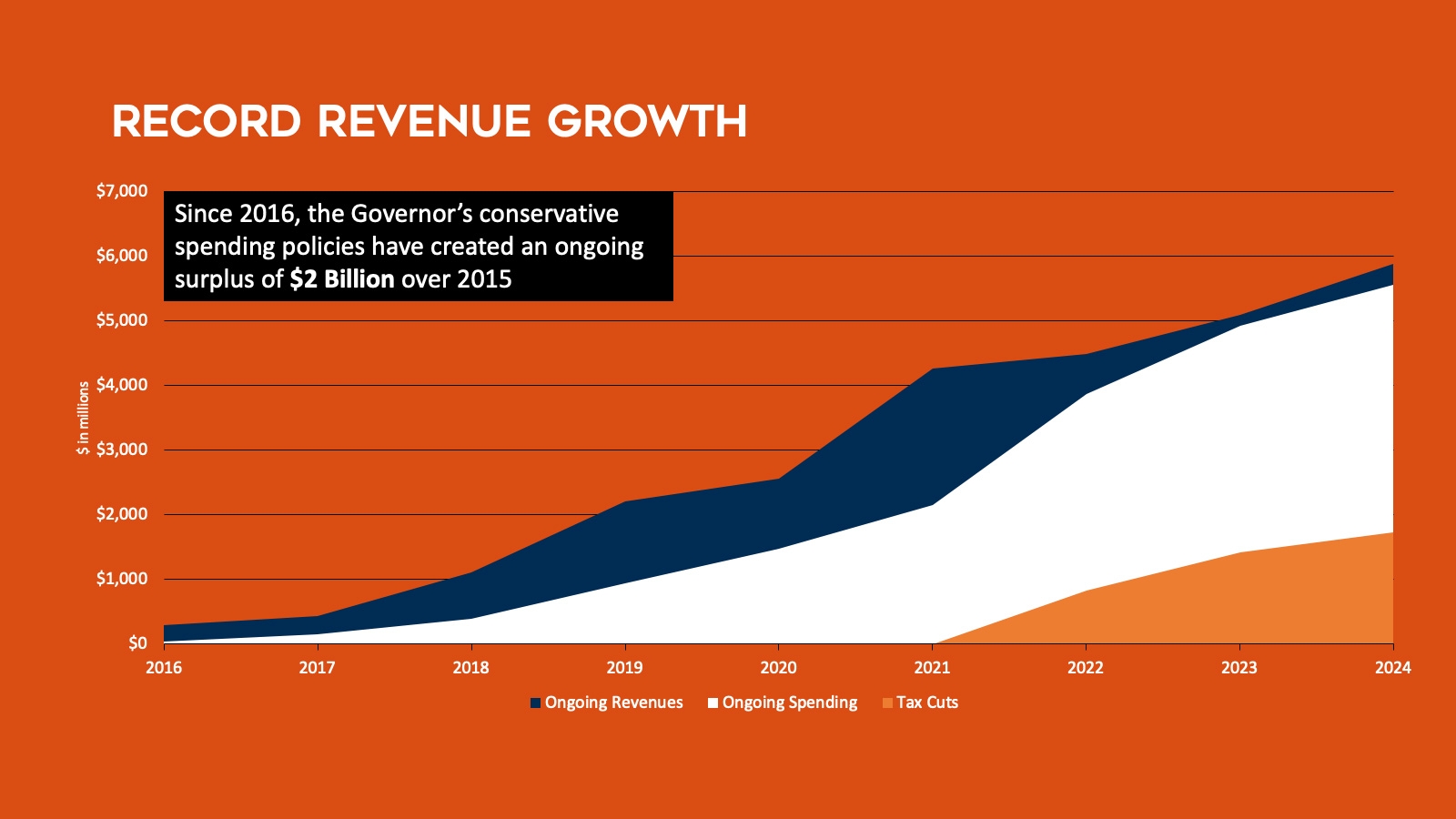

Arizona Is Seeing Record Revenue Growth

With economic success, comes record revenue growth. Our General Fund revenue is up about 25% and last year the state collected $2B more in tax revenues than the previous year. That makes for five consecutive years that Arizona's revenue collections exceeded budgeted forecasts. In fact, economists forecast Arizona will have a $4 billion budget surplus over the next three years.

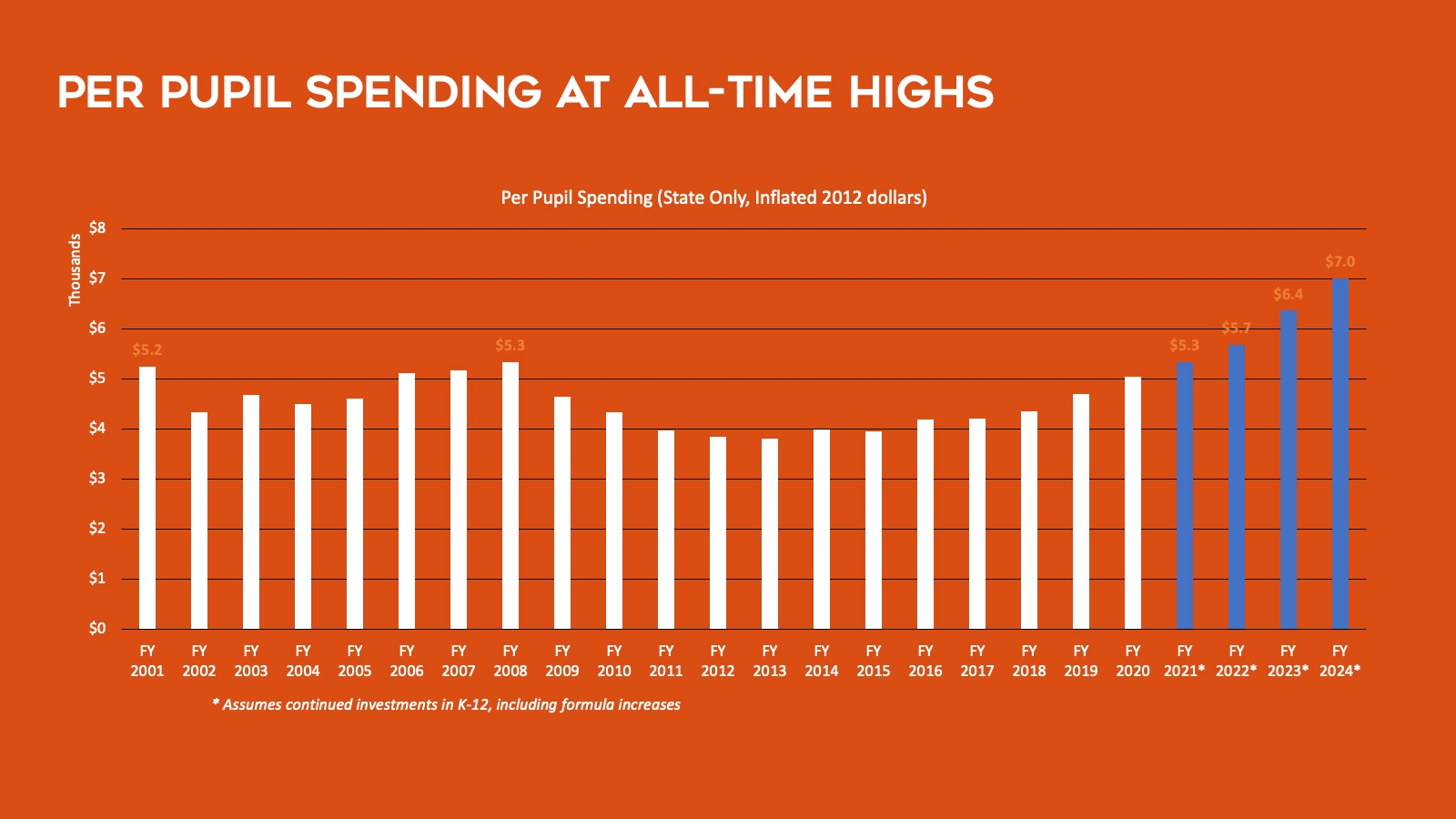

Arizona Is Investing in the Things that Matter

Rather than growing government unnecessarily, Arizona has taken a responsible, conservative approach to spending — prioritizing the things that matter most to Arizonans. We’ve made record investments in K-12 education, universities, infrastructure, and even put away $1 billion in the state’s rainy day fund.

Our budget continues these important investments and includes funding for key priorities, like education funding, public safety body cameras, new roads and bridges, long-term water projects, child care and affordable housing.

Our Plan: Tax Relief for Every Arizonan

From Veterans to working families, to small businesses — we’ve developed a tax reform plan for all Arizonans. Rather than increasing spending and growing government, our plan returns the state’s record revenues to hardworking taxpayers. With our plan, every Arizonan will see a reduction in their tax rate, no matter their income.

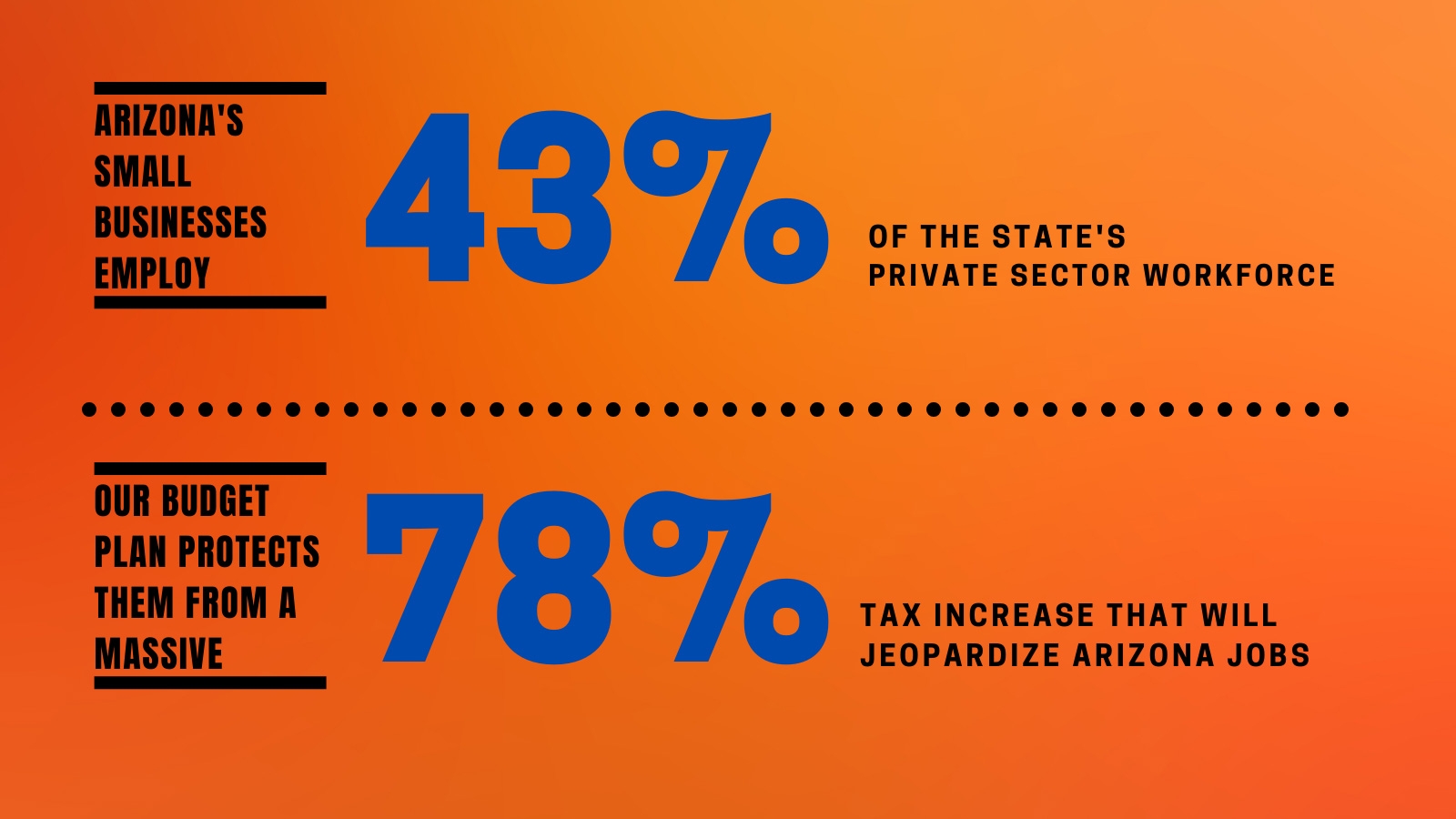

Our Plan: Protecting Small Businesses

Small businesses continue to choose Arizona to start, expand or relocate operations. They are the backbone of our state’s economy, making up more than 99% of Arizona’s businesses and employing more than one million people.

The Governor’s historic tax plan will protect them from burdensome tax hikes by placing a tax max rate of 4.5% and reducing commercial property taxes.

A Responsible Path Forward

The governor’s plan is sustainable, ongoing tax reform that ensures the state can continue investing in the things that matter. It’s a plan that leaves the state’s budget balanced while letting Arizonans keep more of their hard-earned money, and preserves Arizona’s economic competitiveness with surrounding states.